ohio sales tax exemption form reasons

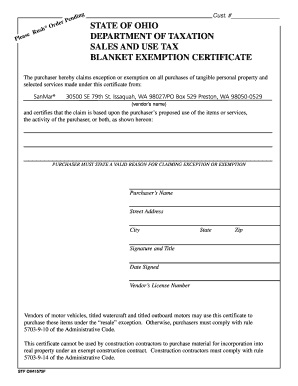

Web Reasons for Tax Exemption in Ohio Sales and Use Tax. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and.

In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

. Sales and Use Tax Blanket Exemption Certificate. We walk through the different sales tax exemptions that apply to. Web Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real.

By its terms this certificate may be used. Ohio also has several additional taxes for. Web To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket.

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the. The state sales and use tax rate is 575 percent. Web A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if.

Web Those are the reasons for our newest law bulletin Ohios Agricultural Sales Tax Exemption Laws. Additionally counties and other municipalities can add discretionary sales and use tax rates. Web Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

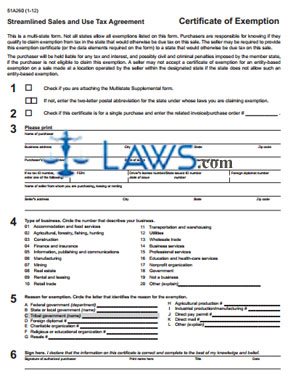

Web Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. Web Ohio Sales Tax Exemption Resale Forms 3 PDFs. As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and.

Web To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a. Web Ohios state sales tax rate is 575 percent. Web The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Sales Tax Exemption For Building Materials Used In State Construction Projects

Ohio Sales Use Tax Guide Avalara

Ohio Tax Exempt Certificate Fill Out Sign Online Dochub

Ohio Sales Tax Small Business Guide Truic

Sales Tax Exemptions Finance And Treasury

Exemption Certificate Forms Department Of Taxation

Country Mfg Ohio Tax Exemption Form Faxable

Sales And Use Tax Unit Exemption Certificate Zephyr Solutions Llc

Free Form Certificate Exemption Streamlined Sales And Use Tax Agreement Free Legal Forms Laws Com

Printable Ohio Sales Tax Exemption Certificates

Ohio Stec B Fill And Sign Printable Template Online

Tax Exempt Form Ohio Fill And Sign Printable Template Online

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Sales Tax After The Wayfair Decision And How It Impacts You Youtube

Ohio Sales Tax Exemption For Manufacturing Agile Consulting

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller